GATEWAY

WEALTH STRATEGIES

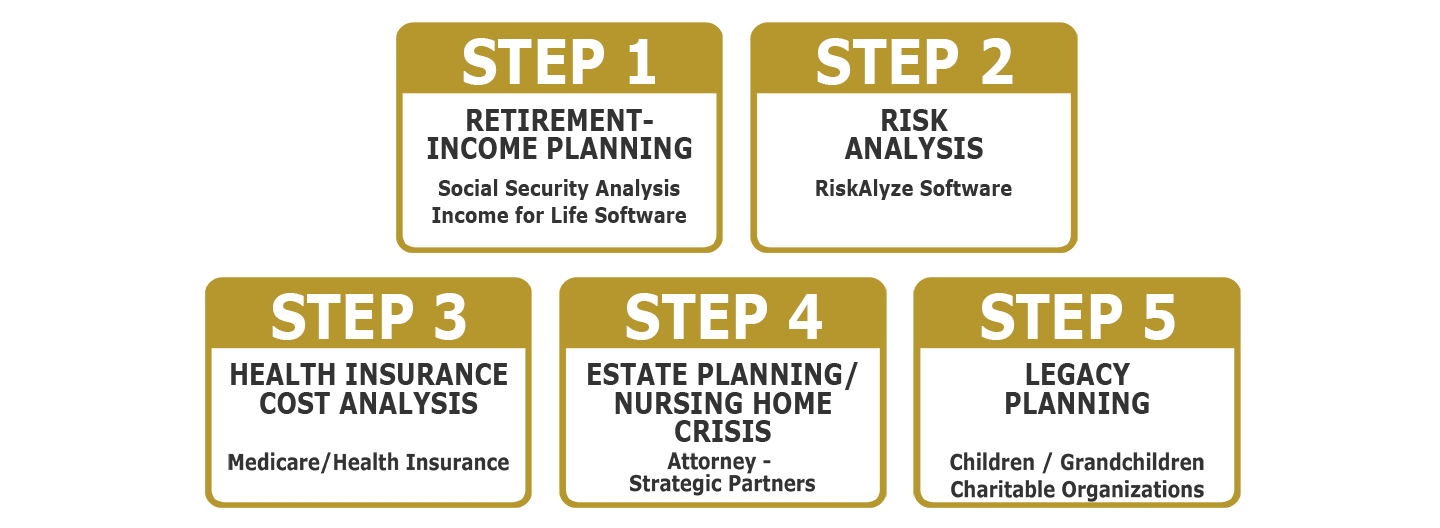

Retirement Planning Made Simple

Our Mission Statement We are committed to maintaining the highest standards of integrity and professionalism in our relationship with you, our client. We endeavor to know and understand your financial situation and provide you with only the highest quality information, services, and products to help you reach your goals.

Our Approach

At Gateway Wealth Strategies, Inc., we think about retirement differently. We believe in world class service that allows you to focus on the things you love and leave the heavy lifting to us.

EXPERIENCE

With a wealth of experience in financial planning strategies, our team works with you to help you develop a strategy that is tailored to your unique needs. We review your entire financial picture.

INDEPENDENCE

Our number one priority is you. We don’t work for any specific company and we recommend what we believe to be in your best interest. This independence allows us to deliver honest, unbiased recommendations.

TEAM

When you start working with us, you benefit from the knowledge of a team that understands the importance of helping you maintain financial health and quality of life.